- New York City won the title of cryptocurrency capital of the US in 2021.

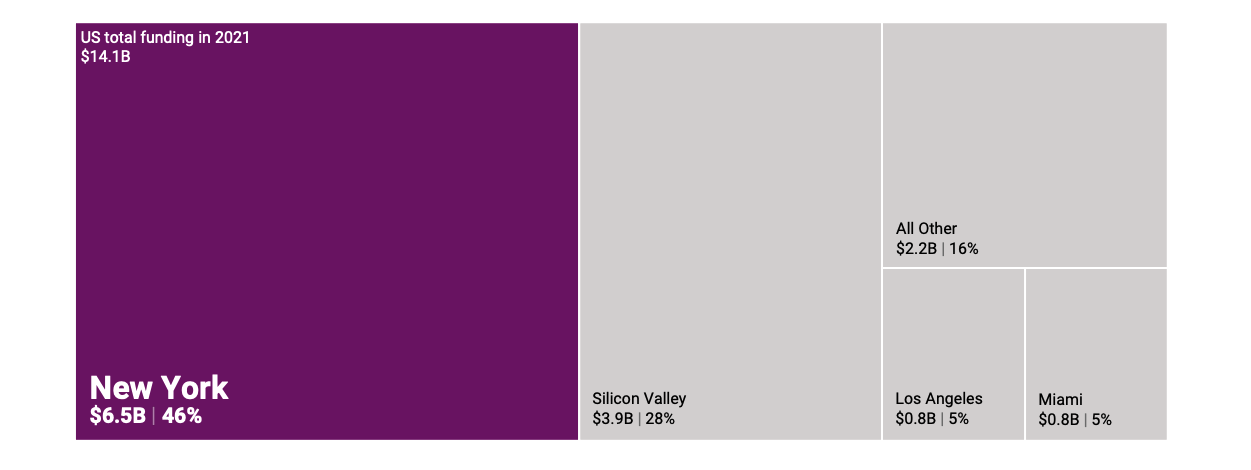

- The Big Apple attracted $6.5 billion in crypto startup funding last year, 46% of the total raised, according to CB Insights.

- New York beat Silicon Valley and Miami, the latter of which has been pushing hard to attract crypto enthusiasts.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

New York City took the crown as cryptocurrency capital of the US in 2021.

The city attracted $6.5 billion in crypto startup funding last year, 46% of all US fundraising in the space, according to CB Insights.

The sum raised was boosted by a blockbuster $1 billion funding round by bitcoin firm NYDIG and a $750 million Series B round by blockchain platform Celsius Network in the last quarter of the year.

New York beat Silicon Valley, which remains the top city overall for venture capital funding and ranks second for blockchain funding. It also surpassed Los Angeles and Miami, which are both tied for third with $760 million raised in 2021.

New York City Mayor Eric Adams has been vocal about wanting to transform New York into a crypto hub, vowing to convert his first three paychecks into crypto as a demonstration of faith in the asset class. Adams, a Democrat, has publicly engaged in some friendly banter with Miami Mayor Francis Suarez, another crypto enthusiast, about which city will be the ultimate crypto capital of the country.

The US saw a total of $14.1 billion in crypto-related funding raised in 2021.

Notably, Coinbase Ventures, the venture capital arm of the largest US crypto exchange, funded 68 blockchain startups in 2021. Its portfolio companies spanned crypto exchanges (FTX), institutional services (Amber Group), and DeFi wallets (ConsenSys). China-based AU21 and Andreessen Horowitz were other top investors.

Worldwide, blockchain funding surged 713% year on year to reach $25 billion last year. Over 1,247 deals were closed, more than doubling 2020's total of 662, CB Insights data showed.

"79% of deals were early stage, signaling a nascent market of developing companies — and an even healthier funding environment in 2022 as startups mature and find product-market fit," the CB Insights report said.